Where’s the hottest places to invest in Spain right now?

Where’s the hottest places to invest in Spain right now?

We think 2016 is going to be a very interesting year for the Spanish property market. The recovery is now well underway and gaining momentum, unemployment continues to fall and the economy is set to be the fastest growing of the “Big Four” euro economies over the next two years, according to the International Monetary Fund.

And, if you needed further convincing that 2016 is the year to invest in Spanish property, the OECD’s latest report on homes in Spain are currently undervalued by 26% makes for interesting reading: www.telegraph.co.uk

Hot tips

The average price for property sales at Lucas Fox during 2015 was around the 1 million Euro mark, and we expect that figure to be more or less the same during 2016. We thought it would be a useful exercise to ask our regional directors where they would spend the money. So if you are thinking of investing in a Spanish home in the next 12 months, take heed..

Barcelona

“The so-called ‘Golden Square’ of Barcelona is a guaranteed location for property investment as it is highly sought after and located in the heart of the city centre.

Within this area, the prestigious main streets including Paseo de Gracia, Calle Balmes and Rambla Cataluña will never go out of fashion and currently still offer attractive prices, but they are beginning to gently increase since late 2014. We have some great New Development projects coming onto the market in and around these areas. I would purchase a couple of our apartments for sale on Calle Balmes 141 if I could. Ready-to-move-into and instant rental yield (5%)”

– Karen Storms, Sales Manager Lucas Fox Barcelona

– Karen Storms, Sales Manager Lucas Fox Barcelona

Beautiful renovated apartments in the heart of Barcelona’s Eixample district

Costa Brava

“I would invest 1 million Euros in a sea view property somewhere between Begur and Calella de Palafrugell. From an investment point of view, it is hard to go wrong. Prices have dropped by 30% – 40% over the past 8 years yet this beautiful stretch of coastline will always be in demand from wealthy local and international clients.

Furthermore there is very little new construction so supply will never outstrip demand. There are plenty of re-sale properties on the market in prime locations with great sea views. Many require renovation so it’s worth keeping some budget aside to upgrade the property, personalise and add value”

– Tom Maidment, Partner Lucas Fox Costa Brava

– Tom Maidment, Partner Lucas Fox Costa Brava

Charming south facing Costa Brava property to buy in Aiguablava with superb sea views

Maresme

“In today’s buyers market, if I had 1 million Euros to invest, I would focus on the one of the best locations of the Maresme Coast – Can Teixidó in Alella. This location is simply ideal, being conveniently located 15 miutes north of Barcelona city centre, a 5 minute drive to the new Hamelin-Laie International School and a short walk from El Masnou Marina. The area offers fantastic Catalan and Spanish restaurants as well as pristine beaches, making this the perfect location to enjoy a “suburban” Mediterranean lifestyle!”

– Rafael Rosendo, Director Lucas Fox Maresme

– Rafael Rosendo, Director Lucas Fox Maresme

6-bedroom villa for sale, located in Can Teixido, Alella, a short distance from Hamelin-Laie International School and 15 minutes from Barcelona City

Sitges

“If I had 1 million Euros to spend in the Sitges area I think the best investment would be to buy a good plot of land somewhere close to town, with incredible sea views such as Vallpineda, Levantina, Montgavina or Can Girona.

Then I would build a beautiful contemporary home designed and styled to my own personal taste. Not only would you end up with the home of your dreams but it would also be a great investment as it would cost you almost half of what a similar finished build would cost!”

– Rachel Haslam, Director Lucas Fox Sitges

– Rachel Haslam, Director Lucas Fox Sitges

Large plot of land with plans for a family home with great sea views in Vallpineda, Sitges

Valencia

“With 1 million Euros, I would purchase a renovated apartment within a Modernista building, located in the heart of the Pla del Remei, the most exclusive area in Valencia’s Eixample district and just steps from an iconic example of Valencian modernism, Colón Market.

It is one of the most sought after locations among foreign investors, whom quadrupled in number from 2011 to April 2014, elevating Valencia to 4th place nationally for foreign buyers. El Pla del Remei in particular, is ideal for those looking for a safe, good value long-term investment, and the exclusivity and tranquility that comes with living in the fashionable Eixample”

– Juan Luis Herrero, Director Lucas Fox Valencia

– Juan Luis Herrero, Director Lucas Fox Valencia

Beautiful, bright apartment for sale, situated in a period building in the neighbourhood of El Pla del Remei in Valencia’s Eixample district

Ibiza

“If I had 1 million Euros to invest in 2016, I would invest in an apartment somewhere along the ‘Golden Mile’ in Marina Botafoch, on the edge of Ibiza Town.

This strip is now THE summer destination and is heavily in demand with those who wish to rub shoulders with the world’s movers and shakers in renowned lavish establishments such as Lío, Heart, Cavalli, Cipriani, It and Pacha. Space is limited here and like Ibiza generally, prices are only going one way. Up!”

– Jason Ham, Head of Business Development

– Jason Ham, Head of Business Development

Fantastic 3-bedroom duplex penthouse in Marina Botafoch, Ibiza Town, with stunning sea views

Madrid

“With 1 million Euros, I would invest in a gem of an apartment to renovate in a classical building in Justicia, around Argensola and Plaza de Salesas. For this sum, you could buy a spacious property with plenty of character (200 – 225m2), situated in one of the most fashionable locations in the capital, next to boutiques and trendy restaurants, offering a superb lifestyle and future profit!”

– Rod Jamieson, Director Lucas Fox Madrid

– Rod Jamieson, Director Lucas Fox Madrid

Luxury 4-bedroom apartment in the gorgeous area of Justicia, right in the centre of Madrid

Marbella

“If I had to choose a location in which to invest 1 million Euros, it would have to be Estepona Town along the beachfront – probably the fastest up-and-coming area on the Costa del Sol. It has been labeled ‘the most attractive town’ on the Costa del Sol thanks to the likes of its narrow cobblestone streets and typical white houses covered in colourful flowers. There are some 30 golf courses in the direct vicinity, a charming marina with a yacht club, restaurants, as well as a local fishing port. Malaga Airport, Marbella, Tarifa and Seville, Gibraltar (Airport) and even Africa can easily be reached from there”

– Stephen Lahiri, Director Lucas Fox Marbella

– Stephen Lahiri, Director Lucas Fox Marbella

Modern 3-bedroom villa close to the beach and amenities for sale off-plan in Estepona, 20 minutes from Puerto Banús

Carrie Frais is Head of Marketing & PR at Lucas Fox

Do you have a question for Carrie? E-mail her here

Sign up for Spanish property updates from us here

Where’s the hottest places to invest in Spain right now?

Where’s the hottest places to invest in Spain right now?

– Karen Storms, Sales Manager Lucas Fox Barcelona

– Karen Storms, Sales Manager Lucas Fox Barcelona

– Tom Maidment, Partner Lucas Fox Costa Brava

– Tom Maidment, Partner Lucas Fox Costa Brava

– Rafael Rosendo, Director Lucas Fox Maresme

– Rafael Rosendo, Director Lucas Fox Maresme

– Rachel Haslam, Director Lucas Fox Sitges

– Rachel Haslam, Director Lucas Fox Sitges

– Juan Luis Herrero, Director Lucas Fox Valencia

– Juan Luis Herrero, Director Lucas Fox Valencia

– Jason Ham, Head of Business Development

– Jason Ham, Head of Business Development

– Rod Jamieson, Director Lucas Fox Madrid

– Rod Jamieson, Director Lucas Fox Madrid

– Stephen Lahiri, Director Lucas Fox Marbella

– Stephen Lahiri, Director Lucas Fox Marbella

The 1st of February 2016 marks a critical day for residential landlords throughout England. It is from this date onwards that all landlords will be legally responsible for checking that all new tenancies issued for their properties are only made to persons legally entitled to reside within England.

The 1st of February 2016 marks a critical day for residential landlords throughout England. It is from this date onwards that all landlords will be legally responsible for checking that all new tenancies issued for their properties are only made to persons legally entitled to reside within England. Simple and fair – the Right To Rent App that’s child’s play

Simple and fair – the Right To Rent App that’s child’s play

February 8th marks the start of the new Chinese Year – The Year of the Monkey

February 8th marks the start of the new Chinese Year – The Year of the Monkey For the first time since 2012, London has slipped out of the top 10 best cities in Europe for property investment to 15th place as a result of high prices and a crunch on yields.

For the first time since 2012, London has slipped out of the top 10 best cities in Europe for property investment to 15th place as a result of high prices and a crunch on yields.

A new law requiring that all new and converted homes in Wales be fitted with sprinklers has come into force, the first of its kind anywhere in the world.

A new law requiring that all new and converted homes in Wales be fitted with sprinklers has come into force, the first of its kind anywhere in the world. Yesterday I watched the UK Prime Minister David Cameron on BBC television as he made various claims about “affordable housing”. The BBC itself summarised it thus.

Yesterday I watched the UK Prime Minister David Cameron on BBC television as he made various claims about “affordable housing”. The BBC itself summarised it thus.

The Help to Buy: Equity Loan scheme helped more than 60,000 people onto the property ladder in Q3 2015, according to the Department for Communities and Local Government (DCLG). Showing an annual increase of 4%, 81% of the purchases were made by first-time buyers, with 50,969 being first properties. Andy Frankish, NewHomes director at Mortgage Advice Bureau, said the scheme continues to reach its target audience of first-time buyers and commented on the new dedicated Help to Buy scheme for first-time buyers London.

The Help to Buy: Equity Loan scheme helped more than 60,000 people onto the property ladder in Q3 2015, according to the Department for Communities and Local Government (DCLG). Showing an annual increase of 4%, 81% of the purchases were made by first-time buyers, with 50,969 being first properties. Andy Frankish, NewHomes director at Mortgage Advice Bureau, said the scheme continues to reach its target audience of first-time buyers and commented on the new dedicated Help to Buy scheme for first-time buyers London. Food for thought at the end of 2015…

Food for thought at the end of 2015… With the rising number of people claiming benefits, there is a great demand for rental properties within the private sector. However, there are not many landlords prepared to consider DSS tenants, even if it means their properties will remain empty for another month(s) to come.

With the rising number of people claiming benefits, there is a great demand for rental properties within the private sector. However, there are not many landlords prepared to consider DSS tenants, even if it means their properties will remain empty for another month(s) to come. properties by yield, terms, buyback or starting prices. Results can quickly be filtered before making an enquiry about multiple listings with a single click. The intuitive, responsive design means that the site is available on the go on any mobile device, offering the most specialised information to the widest possible audience of international investors.

properties by yield, terms, buyback or starting prices. Results can quickly be filtered before making an enquiry about multiple listings with a single click. The intuitive, responsive design means that the site is available on the go on any mobile device, offering the most specialised information to the widest possible audience of international investors. Knight Frank’s latest Prime Country View report highlighted the rise of urban prime in the UK over the past decade. According to the report, prime property values in town and city markets have jumped 26% since 2005, compared to just 7% for rural properties. Whilst rural homes languish at 13% below their 2007 peak, prime city residences have now exceeded their former peak by 3%.

Knight Frank’s latest Prime Country View report highlighted the rise of urban prime in the UK over the past decade. According to the report, prime property values in town and city markets have jumped 26% since 2005, compared to just 7% for rural properties. Whilst rural homes languish at 13% below their 2007 peak, prime city residences have now exceeded their former peak by 3%.

The Bank’s governor, Mark Carney, said he was concerned about high levels of lending to landlords and that the Bank would take action. “There are a number of things happening … we are watching it closely and we will take action,” he told the FT. Mr Carney said the problem was that investors might sell their properties at the same time if house prices fell.

The Bank’s governor, Mark Carney, said he was concerned about high levels of lending to landlords and that the Bank would take action. “There are a number of things happening … we are watching it closely and we will take action,” he told the FT. Mr Carney said the problem was that investors might sell their properties at the same time if house prices fell. Landlords sighed with relief at the Conservative victory in the

Landlords sighed with relief at the Conservative victory in the

Shares are currently trading down on the AIM market, at 96.5p, down six per cent from an opening price of 104.5p. The 240m ordinary shares were placed at 100p each, with proceeds of £25m and giving the company a market cap of £240.3m.

Shares are currently trading down on the AIM market, at 96.5p, down six per cent from an opening price of 104.5p. The 240m ordinary shares were placed at 100p each, with proceeds of £25m and giving the company a market cap of £240.3m.

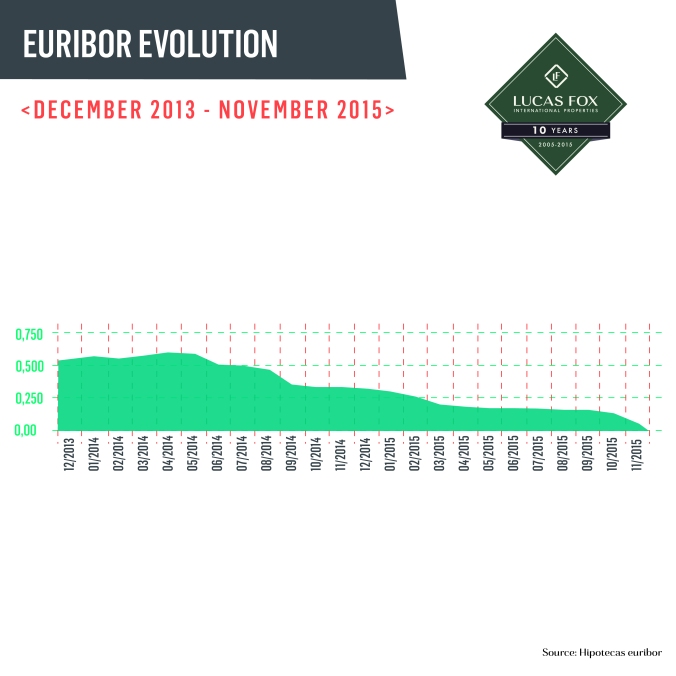

The last time the pound was above at 1.4 euros was in 2007 and it has been consistently so during 2015. According to Euribor, mortgage interest rates in Spain fell close to zero in November, representing yet another historic low. Euribor (the rate used to calculate most mortgage repayments in across Spain) fell month-on-month by 38% in November to 0.079 and by 76% year-on-year. Like house prices, mortgage rates have declined over the years and are now hovering far below their 2008 peak of 5.393%.

The last time the pound was above at 1.4 euros was in 2007 and it has been consistently so during 2015. According to Euribor, mortgage interest rates in Spain fell close to zero in November, representing yet another historic low. Euribor (the rate used to calculate most mortgage repayments in across Spain) fell month-on-month by 38% in November to 0.079 and by 76% year-on-year. Like house prices, mortgage rates have declined over the years and are now hovering far below their 2008 peak of 5.393%.

25 years ago, the world watched in wonder as the first pieces of the Berlin wall came down and the broken city began a long healing process to make it whole once more. Now, no longer content to view this vibrant city from afar, it seems the world has decided to move to Berlin!

25 years ago, the world watched in wonder as the first pieces of the Berlin wall came down and the broken city began a long healing process to make it whole once more. Now, no longer content to view this vibrant city from afar, it seems the world has decided to move to Berlin! The modern age could be said to be defined by connectivity: social media has made a multitude of interactions commonplace, Wi-Fi in public places is becoming increasingly the norm, Google is now the go-to for providing the answer to any debate. And this connectedness is now extending its reach to the modern day home.

The modern age could be said to be defined by connectivity: social media has made a multitude of interactions commonplace, Wi-Fi in public places is becoming increasingly the norm, Google is now the go-to for providing the answer to any debate. And this connectedness is now extending its reach to the modern day home. ortuguese property prices due to rise 5% p.a. for next 5 years (RICS/Ci)

ortuguese property prices due to rise 5% p.a. for next 5 years (RICS/Ci) The total stock of property for sale falls in the UK is at an all time low putting severe pressure on prices that seem determined to spiral upwards. The average annual home price appreciation for England and Wales rises further to 7.3%, driven by lack of supply.

The total stock of property for sale falls in the UK is at an all time low putting severe pressure on prices that seem determined to spiral upwards. The average annual home price appreciation for England and Wales rises further to 7.3%, driven by lack of supply. New legislation is a welcome attempt to deal with problems that have been affecting the private rented sector for years, but does it go far enough, asks Tessa Shepperson of Landlord Law.

New legislation is a welcome attempt to deal with problems that have been affecting the private rented sector for years, but does it go far enough, asks Tessa Shepperson of Landlord Law.